Pm Surya Ghar Loan: Many of the people are planning to install Solar Panel under the scheme Pm Surya Ghar Muft Bijli Yojana, but their main concern is the budget and to overcome this government will provide a subsidy amount to the beneficiary and on other hand Bank Financing Option is also there to reduce the financial load of the person who is not able to arrange the money at the time of installation.

Here is the complete information of finance(loan) offered by Canara Bank{Canara Rooftop Solar (CRTS)}

Pm Surya Ghar Loan upto 3KW-

Purpose:

For installation of Roof Top Solar on grid Photovoltaic (PV) System (Residential) upto 3 kW which includes cost & installation of Grid Interactive Rooftop Solar Photovoltaic (PV) Equipment.

Benefits:

- Lower Rate of Interest.

- Reducing Balance Interest Rate.

- Avail loan for installation of Roof Top Solar On-Grid Photovoltaic (PV) System (Residential) upto 3 kW

- No minimum Annual Income & NTH criteria.

- No processing charges.

- Longer Repayment Period.

Features:

- Quantum: Maximum upto Rs.2.00 lakh (including subsidy)

- Margin: Minimum 10% of total project cost shall be contributed by the Borrower

- Net Annual Income/NTH: No minimum Annual Income & NTH criteria. However, repayment capacity shall be ensured on the basis of self-declaration income declared by the customer.

- Repayment :

(i) Repayment period can be fixed in consultation with the borrower/s subject to maximum period of 10 years. However, repayment shall be fixed in such a manner that the Borrower age shall not exceed 70 years by the end of the repayment tenor.

(ii) In equated monthly instalments (EMIs).

(iii) Repayment holiday – 6 months from the date of 1st disbursement on case to case basis as per requirement. - Security: Hypothecation of the equipment to be purchased out of the loan component.

- Service & all other Charges: Waived

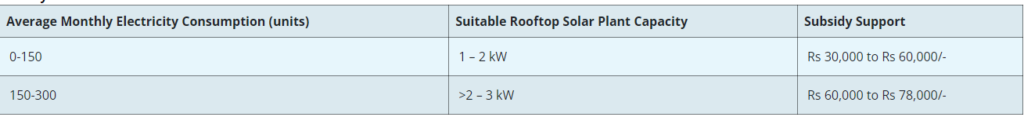

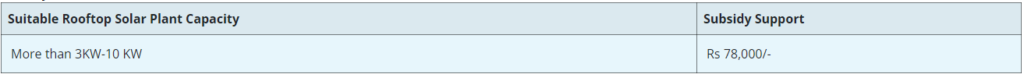

- Subsidy :

Eligibility:

- All individuals i.e Resident Indian Citizens & Non-Resident Indians (NRI) [Persons of Indian Origin (PIOs) & Overseas Citizenship of India (OCI)] are eligible under subject scheme.

- Salaried/Non-Salaried and Professionals Class who are credit worthy including ex-employees & our employees.

- Age: Minimum entry age 18 years & Maximum entry Age 65 years

- CIC Score: 680 & above and (-1 to 99 in case of borrower having no credit history)

- The applicant shall have Roof Top Rights on which the installation is proposed and roof shall have the sufficient area as mandated by MNRE from time to time.

- The latest electricity bill in applicant’s name and regularly paying the electricity bill.

RATES OF INTEREST FOR RETAIL LOANS:

- Rates of Interest For retail Lending Schemes are Linked to RLLR

- Rates Of Interest For retail Lending Schemes are Linked to Fixed Rate of Interest

Documents Required:

- Stipulated Loan Application with 2 passport size photos of Applicant / Co-applicants.

- KYC documents of Applicant/ Co-applicants as per extant guidelines.

- Latest Electricity Bill in the name of the applicant

- Self-declaration of income by the customer

- Technical Feasibility Report provided by Competent Authority of respective Distribution Company (DISCOM) based on site survey.

- Quotation from empanelled list of vendors available at State Nodal Agencies (SNA)/DISCOM/MNRE website

- Model Agreement (duly stamped & executed) Between Applicant and the registered/empanelled Vendor for installation of rooftop solar system.

- Any other documents as required by Bank.

Pm Surya Ghar Loan Between (3KWto10KW)-

Purpose:

For installation of Roof Top Solar on grid Photovoltaic (PV) System (Residential) above 3 KW and upto 10 KW which includes cost & installation of Grid Interactive Rooftop Solar Photovoltaic (PV) Equipment.

Benefits:

- Competitive Rate of Interest.

- Reducing Balance Interest Rate.

- Avail loan for installation of Roof Top Solar On-Grid Photovoltaic (PV) System (Residential) above 3kW to 10kW

- No processing charges.

- Longer Repayment Period.

Features:

- Quantum: Maximum upto Rs.6.00 lakh (including subsidy)

- Margin: Minimum 20% of total project cost shall be contributed by the Borrower

- Net Annual Income/NTH: Rs. 3.00 Lakh Minimum Annual Income

NTH: Applicant should have minimum monthly net take home income of 25% of their gross income OR Rs. 10,000/- whichever is higher after meeting the existing loan instalments along with the proposed loan. - Repayment :

(i) Repayment period can be fixed in consultation with the borrower/s subject to maximum period of 10 years. However, repayment shall be fixed in such a manner that the Borrower age shall not exceed 70 years by the end of the repayment tenor.

(ii) In equated monthly instalments (EMIs).

(iii) Repayment holiday – 6 months from the date of 1st disbursement on case to case basis as per requirement. - Security: Hypothecation of the equipment to be purchased out of the loan component.

- Service & all other Charges: Waived

- Subsidy:

Eligibility:

- All individuals i.e Resident Indian Citizens & Non-Resident Indians (NRI) [Persons of Indian Origin (PIOs) & Overseas Citizenship of India (OCI)] are eligible under subject scheme.

- Salaried/Non-Salaried and Professionals Class who are credit worthy including ex-employees & our employees.

- Age: Minimum entry age 18 years & Maximum entry Age 65 years

- CIC Score: 680 & above and (-1 to 99 in case of borrower having no credit history)

- The applicant shall have Roof Top Rights on which the installation is proposed and roof shall have the sufficient area as mandated by MNRE from time to time.

- The latest electricity bill in applicant’s name and regularly paying the electricity bill.

RATES OF INTEREST FOR RETAIL LOANS:

RATES OF INTEREST FOR RETAIL LENDING SCHEMES

- Rates of Interest For retail Lending Schemes are Linked to RLLR

- Rates Of Interest For retail Lending Schemes are Linked to Fixed Rate of Interest

Documents Required:

- Stipulated Loan Application with 2 passport size photos of Applicant / Co-applicants.

- KYC documents of Applicant/ Co-applicants as per extant guidelines.

- Latest Electricity Bill in the name of the applicant

- For Salaried/Employed/ Self Employed/Professional and other beneficiaries- Salary Certificate, Salary Slips, Form 16, ITRs, Income Certificate from Revenue Authority etc whichever is applicable to be obtained, verified and satisfied.

- Technical Feasibility Report provided by Competent Authority of respective Distribution Company (DISCOM) based on site survey.

- Quotation from empanelled list of vendors available at State Nodal Agencies (SNA)/DISCOM/MNRE website

- Model Agreement (duly stamped & executed) Between Applicant and the registered/empanelled Vendor for installation of rooftop solar system.

- Any other documents as required by Bank.

Also Read-Vendor List / Details

| Important Links | 👇 |

|---|---|

| Solar Rooftop Calculator | Click Here |

| Subsidy Structure | Click Here |

| Vendor List / Details | Click Here |

| State Wise Vendor List | Click Here |

| Registration | Click Here |

| Login | Click Here |

| DISCOM Portal Link | Click Here |

| DISCOM Contact Details | Click Here |

| Bank Financing Options | Click Here |

| PM Vishwakarma Yojana | Click Here |